The Wine on Premise UK 2025 report is somewhat similar to the wine list itself – a designer to help those who use it to find what they are looking for. It is a revelation that the best distributors should work with, to what the most listed brands and wine styles are to the prices imposed by the bottle or bottle. Here we are studying the most countries and regions of demand and what you may have to pay to buy their wizards. Peter Makatamini reports.

Spain and Portugal

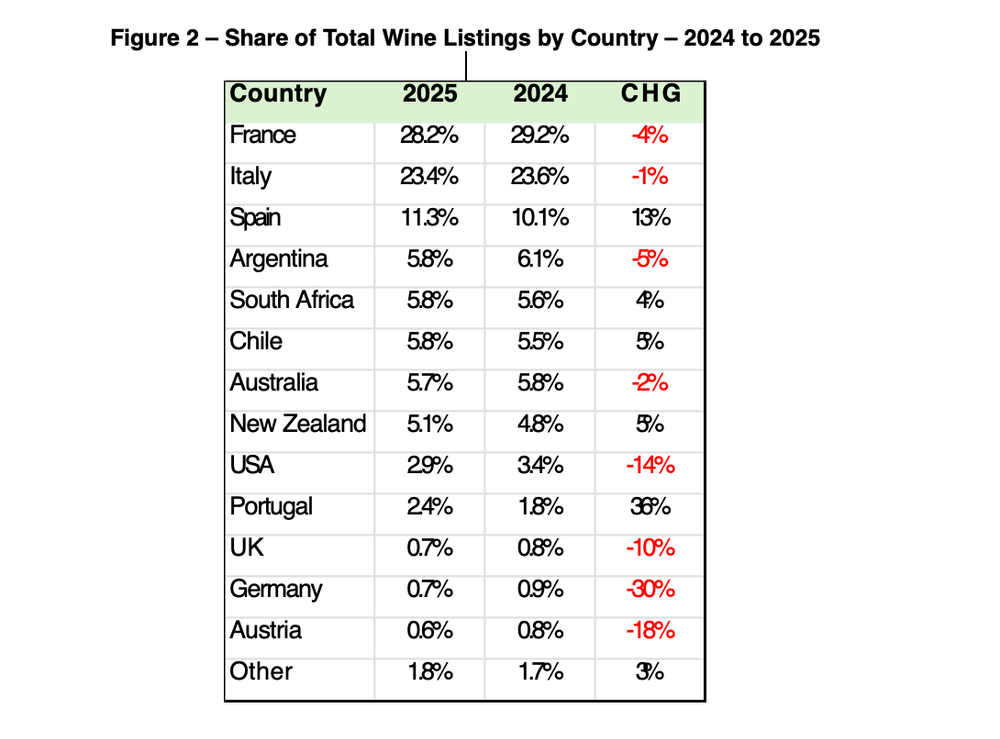

Spain and Portugal have been the most successful country in terms of developing its share of lists of wine lists in the United Kingdom over the past 12 months. Spain's success comes to two factors.

First, an increased awareness of white wine in northern Spain. This includes a significant increase in Viura (also known as Macabeo in Catalonia).

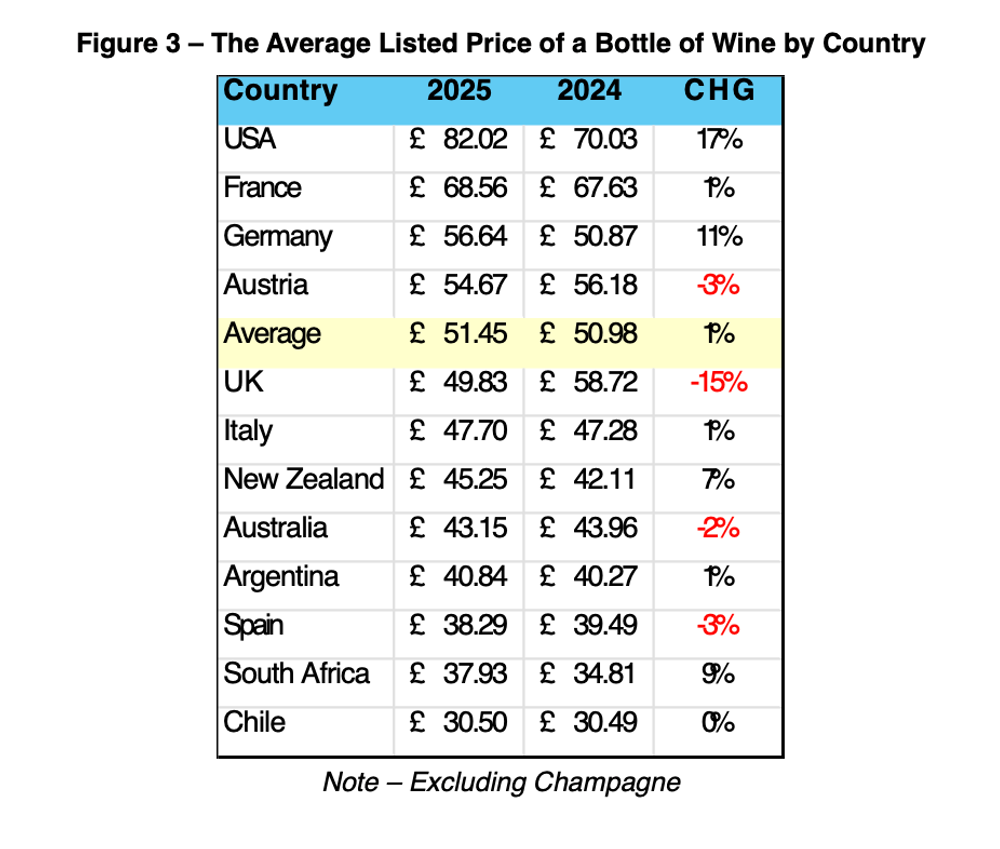

Second, red wine is cheaper than La Mancha and DOS surrounding it. This will not necessarily help the image of Spain and prove the clouds on the average prices.

For Portugal, the Minho area had a large elevator in the menus, also due to increased consciousness and the preference of white wine on the northern Iberian Peninsula. Anyone attending Paris wine, for example, could not miss the presence of wine makers in Vinho Verdi.

France

France has lost most of the lists of the three countries that produce wine, but it will surely recover it with the market receipt again. It is always doing. Shambania and Bordeaux have increased their lists despite the problems facing both regions, on a wider scale.

Italy

Italy is more or less stable, in general. There was a significant decrease in Prostco lists, which tend to replace it with French Crémant and in the cheaper Pinot Grigio. However, areas such as Marche, Emilia-Romagna, Abruzzo and Sicily attract more attention as well as red wines in the gun.

Argentina and Chile

It seems that Argentina has finally reached its climax, but you can never calculate Argentina. Malbec is still the most red wine style included in the wine lists in the UK and Mendoza, the most narrative red wine source.

Chile witnessed an increase in her legs, but at prices now well with the rest of the market.

South Africa and New Zealand

South Africa is located in the region in particular, where it comes to its white wine. They and New Zealand are the only countries that produce the new wine that has increased their share of the menus with a steady increase.

Australia

Australia continues to decrease in the long run with a few lessons learn about how to play in this or any other international market for trade.

US

The United States is the fastest decline in the new world. Strong currency, semi -alternative prices at the upper end and many lists at the bottom make the UK a difficult market for medium American producers who need to be good representatives here until the category succeeds.

UK

The UK industry only runs back when the menus need a rapid increase. If you take out a chapel down and wine producers on the table, then the sparkling English wine, which is seen alone, is in an unstable position.

Austria and Germany

After a very strong tour in recent years, it seems that the market has turned its attention from aromatic wine, including Austrian and German wine. One of the great puzzles in this market is the reason that the German Risling, especially, is still a broader actress. Australian Risling (Claire Valley), at least, cultivating the base of the fans.

Pricing

Prices did not change in general from last year after a period of great inflation, which means that the ordinary consumer may drink wine worse after absorbing the increases in the duty to consume and increase other costs. However, restaurants and their suppliers get more trick, in terms of searching for value in the wine world.

Note – except for champagne

* You can find more ideas of wine business solutions here.

* To learn more and ask for a local wine report in the UK 2025 Click here.